Abstract

Several major economies rely heavily on fossil fuel production and exports, yet current low-carbon technology diffusion, energy efficiency and climate policy may be substantially reducing global demand for fossil fuels1,2,3,4. This trend is inconsistent with observed investment in new fossil fuel ventures1,2, which could become stranded as a result. Here, we use an integrated global economy–environment simulation model to study the macroeconomic impact of stranded fossil fuel assets (SFFA). Our analysis suggests that part of the SFFA would occur as a result of an already ongoing technological trajectory, irrespective of whether or not new climate policies are adopted; the loss would be amplified if new climate policies to reach the 2 °C target of the Paris Agreement are adopted and/or if low-cost producers (some OPEC countries) maintain their level of production (‘sell out’) despite declining demand; the magnitude of the loss from SFFA may amount to a discounted global wealth loss of US$1–4 trillion; and there are clear distributional impacts, with winners (for example, net importers such as China or the EU) and losers (for example, Russia, the United States or Canada, which could see their fossil fuel industries nearly shut down), although the two effects would largely offset each other at the level of aggregate global GDP.

Similar content being viewed by others

Main

The Paris Agreement aims to limit the increase in global average temperature to “well below 2 °C above pre-industrial levels”5. This requires that a fraction of existing reserves of fossil fuels and production capacity remain unused, hence becoming SFFA6,7,8,9,10. Where investors assume that these reserves will be commercialized, the stocks of listed fossil fuel companies may be overvalued. This gives rise to a ‘carbon bubble’, which has been emphasized or downplayed by reference to the credibility of climate policy8,9,11,12,13,14. Here, we show that climate policy is not the only driver of stranding. Stranding results from an ongoing technological transition, which remains robust even if major fossil fuel producers (for example, the United States) refrain from adopting climate mitigation policies. Such refusal would only aggravate the macroeconomic impact on producers because of their increased exposure to stranding as global demand decreases, potentially amplified by a likely asset sell-out by lower-cost fossil fuel producers and new climate policies. For importing countries, a scenario that leads to stranding has moderate positive effects on GDP (gross domestic product) and employment levels. Our conclusions support the existence of a carbon bubble that, if not deflated early, could lead to a discounted global wealth loss of US$1–4 trillion, a loss comparable to the 2008 financial crisis. Further economic damage from a potential bubble burst could be avoided by decarbonizing early.

The existence of a carbon bubble has been questioned on grounds of credibility or timing of climate policies11,12. That would explain investors’ relative confidence in fossil fuel stocks11,12 and the projected increase in fossil fuel prices until 20402. Yet, there is evidence that climate mitigation policies may intensify in the future. A report covering 99 countries concludes that over 75% of global emissions are subject to an economy-wide emissions-reduction or climate policy scheme15. Moreover, the ratification of the Paris Agreement and its reaffirmation at COP22 (the 22nd Conference of the Parties) have added momentum to climate action despite the position of the new US administration16. Furthermore, low fossil fuel prices may reflect the intention of producer countries to sell out their assets, that is, to maintain or increase their level of production despite declining demand for fossil fuel assets17. But that is not all.

Irrespective of whether or not new climate policies are adopted, global demand growth for fossil fuels is already slowing in the current technological transition1,2. The question then is whether, under the current pace of low-carbon technology diffusion, fossil fuel assets are bound to become stranded due to the trajectories in renewable-energy deployment, transport fuel efficiency and transport electrification. Indeed, the technological transition currently underway has major implications for the value of fossil fuels, due to investment and policy decisions made in the past. Faced with SFFA of potentially massive proportions, the financial sector’s response to the low-carbon transition will largely determine whether the carbon bubble burst will prompt a 2008-like crisis11,12,14,18.

We use a simulation-based integrated energy–economy–carbon-cycle–climate model, E3ME-FTT-GENIE (Energy-Environment-Economy Macroeconomic–Future Technology Transformations–Grid Enabled Integrated Earth) (see Methods and Supplementary Table 1), to calculate the macroeconomic implications of future SFFA. Integrated assessment models generally rely on general-equilibrium methods and systems optimization19,20,21. Such models struggle to represent the effects of imperfect information and foresight for real-world agents and investors. By contrast, a dynamic simulation-based model relying on empirical data on socio-economic and technology diffusion trajectories can better serve this purpose (see Supplementary Note 1). In this method, investments in new technology and the interactional effects of changing social preferences generate momentum for technology diffusion that can be quantitatively estimated for specific policy sets. Our model, E3ME-FTT-GENIE, is currently the only such simulation-based integrated assessment model that couples the macroeconomy, energy and the environment covering the entire global energy and transport systems with detailed sectoral and geographical resolution22,23,24.

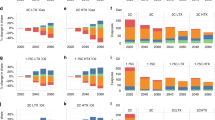

We study and compare three main scenarios (see Table 1 and Methods for details): fuel use from the International Energy Agency’s (IEA) ‘new policies scenario’, which we call ‘IEA expectations’ to reflect the influence of the IEA’s projections on the formation of investor and policymaker expectations as to future demand (see Fig. 1a,b for electricity generation and transport); our own E3ME-FTT ‘Technology Diffusion Trajectory’ projection with energy demand derived from our technology diffusion modelling in the power25, road transport26, buildings and other sectors under the ongoing technological trajectory (Fig. 1c,d); and a projection, which we call the ‘2 °C’ scenario, under a chosen set of policies that achieve 75% probability of remaining below 2 °C (Fig. 1e,f; see Supplementary Fig. 1 for climate modelling), while keeping the use of bioenergy below 95 EJ yr−1 and thereby limiting excessive land-use change27. Only the Technology Diffusion Trajectory and 2 °C scenarios rely on FTT technology diffusion modelling.

a,b, Global IEA fuel demand in the IEA expectations scenario. c–f, Technology composition in electricity generation (c,e) and road transport (in terms of trillion passenger kilometres travelled, Tpkm; d,f) in our Technology Diffusion Trajectory (c,d) and 2 °C (e,f) scenarios. IEA fuel demand is taken from ref. 2. Dashed lines refer to our Technology Diffusion Trajectory scenario for comparison. CCS, carbon capture and storage; CC, combined cycle; IGCC, integrated gasification CC; CCGT, CC gas turbine; BIGCC, biomass IGCC; PV, photovoltaic; CSP, concentrated solar power; CNG, compressed natural gas; EV, electric vehicle; Adv, higher-efficiency combustion; Econ, engine size < 1,400 cc; Mid, 1,400cc ≤ engine size < 3,000 cc; Lux, engine size ≥ 3,000 cc.

Unlike the IEA expectations scenario, our Technology Diffusion Trajectory scenario captures technology diffusion phenomena by relying on historical data and projecting these data into the future. Importantly, historical data implicitly include the effects of past policies and investment decisions. On that basis, the Technology Diffusion Trajectory scenario reflects higher energy efficiency and leads to lower demand. Liquid fossil fuel use in transport peaks in both the Technology Diffusion Trajectory and 2 °C scenarios before 2050 (Figs. 1 and 2a; for sectoral fuel use and emissions, see Supplementary Fig. 2). Solar energy partially displaces the use of coal and natural gas for power generation. On the basis of recent diffusion data (see Methods and Supplementary Table 1), our model suggests that a low-carbon transition is already underway in both sectors. Our sensitivity analysis (Supplementary Note 2 and Supplementary Table 3) confirms that these results are robust and driven by historical data rather than by exogenous modelling assumptions.

a, Global production of fossil fuels, for the IEA expectations (IEA) scenario, our Technology Diffusion Trajectory scenario (TDT) and our 2 °C policies scenario. b, Change in total fossil fuel production between the 2 °C policies scenario and TDT. c,d, Marginal costs of fossil fuels in the same three scenarios, without sell-out (c) and with sell-out (d). e,f, Changes in GDP and employment between the 2 °C policies sell-out scenario and TDT without sell-out (negative means a loss). The width of traces represents maximum uncertainty generated by varying technology parameters (see Supplementary Table 3 and Supplementary Note 2). OPEC excludes Saudi Arabia for higher detail. Macro impacts for Canada feature higher levels of economic uncertainty (not shown), because such high impacts could be mitigated in reality by various policies such as deficit spending by the government; however, we exclude studying deficit spending here for simplicity of interpretation (we assume balanced budgets).

Importantly, the lower demand for fossil fuels leads to substantial SFFA, whether or not 2 °C policies are adopted (Fig. 2a). For individual countries, the effects vary depending on regional marginal costs of fossil fuel production, with concentration of production in OPEC (Organization of the Petroleum Exporting Countries) members where costs are lower (Fig. 2b). Regions with higher marginal costs experience a steep decline in production (for example, Russia), or lose almost their entire oil and gas industry (for example, Canada, the United States).

The magnitude of the loss depends on a variety of factors. Our analysis suggests that the behaviour of low-cost producers and/or the adoption of 2 °C policies can lead to an amplification of the loss (see Table 1 and Supplementary Table 2). The magnitude of the loss may indeed be amplified if low-cost producers decide to increase their ratio of production relative to reserves to outplay other asset owners and minimize their losses (‘selling out’: a detailed definition is given in Methods and Supplementary Note 3) (Fig. 2c,d). Slowing or peaking demand leads to fossil fuel prices peaking (without sell-out) or immediately declining (with sell-out). In the 2 °C scenario, fossil fuel markets substantially shrink and the prices fall abruptly between 2020 and 2030, a potentially disastrous scenario with substantial wealth losses to asset owners (investors, companies) but not to consumer countries. This result highlights the important strategic implications of decarbonization for the EU (European Union), China and India (consumers) compared with the United States, Canada or Russia (producers).

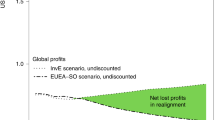

At the global level, it is possible to quantify the potential loss in value of fossil fuel assets (see Supplementary Note 4). If we assume that investment in fossil fuels in the present day continues on the basis of questioning commitments to policy, the return expectations derived from the IEA expectations projection and the assets’ rigid lifespan with expected returns until 2035, and then if, contrary to investors’ expectations, policies to achieve the 2 °C target are adopted, and low-cost producers sell-out their assets, then approximately US$12 trillion (in 2016 US dollars, which amounts to US$4 trillion present value when discounted with a 10% corporate rate) of financial value could vanish off their balance sheets globally in the form of stranded assets (see Supplementary Table 2). This is over 15% of global GDP in 2016 (US$75 trillion). This quantification arises from pairing the IEA expectations scenario with the 2 °C scenario with sell-out. If instead of the IEA expectations, we pair our own baseline (the Technology Diffusion Trajectory scenario) with the 2 °C scenario under the sell-out assumption, the total value loss from SFFA is approximately US$9 trillion (in 2016 US dollars; US$3 trillion with 10% discount rate; see Supplementary Table 2). Our quantification is broadly consistent with recent financial exposure estimates calculated at a regional and country level for the EU and the United States14 (detailed explanation in Supplementary Note 4). Note that a 10% discount rate represents an investment horizon of about 10–15 years, and that fossil fuel ventures have lifetimes ranging between 2 (shale oil) and 50 (pipelines) years (oil wells: 15–30 years; oil tankers: 20–30 years; coal mines: >50 years). For reference, the subprime mortgage market value loss that took place following the 2008 financial crisis was around US$0.25 trillion, leading to global stock market capitalization decline of about US$25 trillion18.

Regarding the impact of SFFA on GDP and employment, Fig. 2e,f show the change in GDP and employment between the Technology Diffusion Trajectory scenario without sell-out and the 2 °C scenario with sell-out, for several major economies/groups. The low-carbon transition generates a modest GDP and employment increase in regions with limited exposure to fossil fuel production (for example, Germany and most EU countries, and Japan). This is due to a reduction of the trade imbalance arising from fossil fuel imports, and higher employment arising from new investment in low-carbon technologies. The improvement occurs despite the general increase of energy prices and hence costs for energy-intensive industries23,24. Meanwhile, fossil fuel exporters experience a steep decline in their output and employment due to the near shutdown of their fossil fuel industry. These patterns emerge alongside a <1% overall impact of the transition on global GDP (<1% GDP change), indicating that impacts are primarily distributional, with clear winners (for example, the EU and China) and losers (for example, the United States and Canada, but also Russia and OPEC countries).

In both the Technology Diffusion Trajectory and 2 °C scenarios, a substantial fraction of the global fossil fuel industry eventually becomes stranded. In reality, these impacts should be felt in two independent ways (see Supplementary Note 4): through wealth losses and value of fossil fuel companies and their shareholders, and through macroeconomic change (GDP and employment losses in the fossil fuel industry, structural change), leaving winners and losers. Figure 3a compares cumulative GDP changes with the cumulative 2016 value of SFFA between the present and 2035. Due to different country reliance on the fossil fuel industry, impacts have different magnitudes and directions (see Supplementary Note 5).

a, Discounted cumulated fossil fuel value loss to 2035 for oil, gas and coal, and GDP changes up to 2035, between the 2 °C sell-out scenario and the IEA expectations scenario (see Supplementary Table 2 and Supplementary Fig. 4 for other scenarios and aggregation methods). Negative bars indicate losses. Error bars represent maximum uncertainty on total SFFA generated by varying technology parameters (see Supplementary Table 3 and Supplementary Note 2; Supplementary Table 4 provides a breakdown for individual fuels). b,c Percent change in GDP (b) and labour force employment (c) between the 2 °C sell-out scenario and our Technology Diffusion Trajectory non-sell-out scenario (solid lines), and between the 2 °C sell-out scenario with a US withdrawal from climate policy and our Technology Diffusion Trajectory non-sell-out scenario (dashed lines).

Reducing fossil fuel demand generates an overall positive effect for the EU and China and a negative one for Canada and the United States. Figure 3b,c shows, however, that since impacts on the Canadian and US economies primarily depend on decisions taken in the rest of the world, the United States is worse off if it continues to promote fossil fuel production and consumption than if it moves away from them. This is due to the way global fossil fuel prices are formed. If the rest of the world reduces fossil fuel consumption and there is a sell-out, then lower fuel prices will make much US production non-viable, regardless of its own policy, meaning that its assets become stranded. If the United States promotes a fossil fuel-intensive economy, then the situation becomes worse, as it ends up importing this fuel from low-cost producers in the Middle East, while it forgoes the benefits of investment in low-carbon technology (for other countries, see Supplementary Fig. 3, Supplementary Table 8 and Supplementary Note 5).

Importantly, the macroeconomic impacts of SFFA on producer countries are primarily determined by climate mitigation decisions taken by the sum of consuming countries (for example, China or the EU), and thus a single country, however large, cannot alter this trajectory on its own. Also, critically, this finding contradicts the conventional assumption that global climate action is accurately described by the prisoner’s dilemma game, which would allow a country to free-ride. But an exposed country can mitigate the impact of stranding, by divesting from fossil fuels as an insurance policy against what the rest of the world does. What remains to be known, however, is the degree to which SFFAs impose a risk to regional and global financial stability.

Methods

Detailed scenario definitions

IEA expectations

In the IEA expectations scenario, we replace our energy model (FTT and E3ME estimations) by exogenous fuel use data from the IEA’s new policies scenario2. We derive macroeconomic variables from the evolution of a fixed energy system (FTT is turned off). We use our fossil fuel resource depletion model to estimate changes in the marginal cost of production of fossil fuels. This enables us to calculate fossil fuel asset values. Given that this scenario does not make use of our technology projections with FTT, we use this scenario with the interpretation that it represents the expectations of investors who do not fully realize the state of change of technology, in particular electric vehicles and renewables, that, as we argue in the text, is taking place.

Technology Diffusion Trajectory

In the Technology Diffusion Trajectory scenario, we use the three FTT diffusion models and our own E3ME energy sector model (see Supplementary Table 1) to estimate changes in fuel use due to the diffusion of new technologies. This is the baseline of the E3ME-FTT-GENIE model, which differs substantially from the IEA’s. We interpret this scenario as that which, we argue, is likely to be realized instead of the IEA expectations scenario, according to the current technological trajectory observed in historical data that parameterize our models, if no climate policies are adopted. Policies are not specified explicitly, but instead are implicitly taken into consideration through the data.

In the 2 °C scenario, we choose a set of policies that achieve 75% chance of not exceeding 2 °C of peak warming, according to the GENIE model, itself validated with respect to Coupled Model Intercomparison Project Phase 5 models (see Supplementary Fig. 1). We estimate the diffusion of new low-carbon technologies and evolution of the energy sector under these policies using E3ME-FTT. Policies (for example, subsidies, taxes, regulations) are specified explicitly.

Sell-out versions of all scenarios

In both the Technology Diffusion Trajectory and 2 °C scenarios, the issue of the sell-out of fossil fuel resources by low-cost producers is a real but not inevitable possibility. We therefore present both sell-out and non-sell-out versions for each scenario. The sell-out is defined by increasing production-to-reserve ratios of producer countries, which concentrates production to OPEC and other low-cost production areas. Meanwhile, in the non-sell-out scenarios, these ratios are constant, as they have been until recently28. These assumptions are exogenous (see Supplementary Note 3). SFFAs are given for all combinations in Supplementary Table 2.

Policy assumptions for achieving a 2 °C target

The set of policies that we use to reach the Paris targets constitutes one of many possible sets that could theoretically reach the targets. They achieve emissions reductions consistent with a 75% probability of reaching the 2 °C target, and include the following.

Multiple sectors

CO2 pricing is used to incentivize technological change across sectors in E3ME-FTT. One price/tax is defined exogenously, in nominal US dollars, at every year for every country, shown in Supplementary Fig. 5a. This policy applies to power generation and all heavy industry sectors (oil and gas, metals, cement, paper and so on). It is not applied to households or to road transport.

Electricity generation

Combinations of policies are used to efficiently decarbonize electricity generation, following earlier work25. These involve CO2 pricing (see above) to incentivize technological change away from fossil fuel generators, subsidies to some renewables (biomass, geothermal, carbon capture and storage) and nuclear to level the playing field, feed-in tariffs for wind and solar-based technologies, and regulations to phase out the use of coal-based generators (none newly built). In some countries (foremost the United States, China, India), a kick-start programme for carbon capture and storage and bioenergy with carbon capture and storage is implemented to accelerate its uptake. All new policies are introduced in or after 2020.

Road transport

Combinations of policies are used to incentivize the adoption of vehicles with lower emissions, following earlier work26. These include (1) fuel efficiency regulations for new liquid-fuel vehicles; (2) a phase-out of older models with lower efficiency; (3) kick-start procurement programmes for electric vehicles where they are not available (by public authorities or private institutions, for example, municipality vehicles and taxis); (4) a tax starting at US$50 per gCO2 per km (2012 values) to incentivize vehicle choice; (5) a fuel tax (increasing from US$0.10 per litre of fuel in 2018 to US$1.00 in 2050; 2012 prices) to curb the total amount of driving; (6) biofuel mandates that increase from current values to between 10% and 30% (40% in Brazil) in 2050, different for every country, extrapolating IEA projections29.

Industrial sectors

Fuel efficiency policy and regulations are used, requiring firms to invest in more recent, higher-efficiency production capital and processes, beyond what is delivered by the carbon price. These measures are publicly funded, following the IEA’s 450 ppm scenario assumptions29. Further regulations are used that ban newly built coal-based processes (for example, boilers) in all sectors.

Buildings

For households, we assume a tax on the residential use of fossil fuels (starting at US$60 per tCO2 in 2020, linearly increasing by US$6 per tCO2 per year; 2016 prices), and subsidies on modern renewable heating technologies (starting at −25% in 2020, gradual phase-out after 2030). Commercial buildings increase energy efficiency rates, following the assumptions in the IEA’s 450 ppm scenario29.

The simulation-based integrated assessment model

E3ME-FTT-GENIE is an integrated assessment simulation model that comprises a model of the global economy and energy sector (E3ME), three subcomponents for modelling technological change with higher detail than E3ME (the FTT family), a global model of fossil fuel supply and an integrated model of the carbon cycle and climate system (GENIE). E3ME, FTT and the fossil fuel supply model are hard-linked in the same computer simulation, while GENIE is run separately, connected to the former group by soft coupling (transferring data). A peer-reviewed description of the model with fully detailed equations is available with open access22; key model codes and datasets can be obtained from the authors upon request.

The E3ME model

E3ME is a highly disaggregated demand-led global macroeconometric model30,31,32,33 based on post-Keynesian foundations24,33,34, which implies a non-equilibrium simulation framework (see Supplementary Table 1). It assumes that commercial banks lend according to bank reserves, which are created on demand by the central bank34,35,36. This means that increased demand for technologies and intermediate products in the process of decarbonization is financed (at least in part) by bank loans, and that spare production capacity in the economy and existing unemployment lead to possible output boosts during major building periods and to slumps during debt repayment periods24. In the jargon of the field, whereas computable general-equilibrium models normally ‘crowd out’ finance (additional investment in a given asset class implies a compensating reduction in investment in other asset classes), E3ME assumes a full availability of finance through credit creation by banks (additional investment in one sector does not require cancelling investment elsewhere; see ref. 24 for a discussion). E3ME does not feature an explicit representation of the sectoral detail of the financial sector (it is not stock-flow consistent) or model financial contagion; however, it does feature endogenous money through its investment equations, which is necessary and sufficient for this paper.

E3ME has 43 sectors of production, 22 users of fuels, 12 fuels and 59 regions. It uses a chosen set of 28 econometric relationships (including employment, trade, prices, investment, household consumption, energy demand) regressed over a corresponding high-dimension dataset covering the past 45 years, and extrapolates these econometric relationships self-consistently up to 2050. E3ME includes endogenous technological change in the form of technology progress indicators in each industrial sector and fuel user, providing the source of endogenous growth. It is not an equilibrium model; it is path-dependent and demand-led in the Keynesian sense. E3ME has been used in numerous policy analyses and impact assessments for the European Commission and elsewhere internationally (for example, see refs 37,38,39). Recent discussions of the implications for results of the choice of an economic model for assessing the impacts of energy and climate policies are given in refs 24,33. Previously, such debates have often concerned simpler types of integrated assessment models (for example, the Dynamic Integrated Climate–Economy model)40,41,42, while newer debates are emerging that address issues of framing and philosophy of science43,44. Recent empirical studies appear to find no evidence for crowding-out in the finance of innovation, from the perspective of access to finance45,46. E3ME has been validated against historical data by reproducing history between 1972 and 2006, on the basis of the normal regression parameters47.

The FTT model

Technology diffusion is not well described by time-series econometrics, as it involves nonlinear diffusion dynamics (S-shaped diffusion48). To improve our resolution of technological change in the fossil fuel-intensive sectors of electricity and transport, we use the FTT family of sectoral evolutionary bottom-up models of technological change dynamically integrated to E3ME22,25,26,49. FTT projects existing low-carbon technology diffusion trajectories on the basis of observationally determined preferences of heterogeneous consumers and investors, using a diffusion algorithm.

FTT models market share exchanges between competing technologies in the power, road transport and household heating sectors on the basis of technology ‘fitness’ to consumer/investor preferences. Agents have probabilistically distributed preferences calibrated on cross-sectional market datasets26,49,50. Choices are evaluated using chains of binary logits, weighted by their market share. The diffusion patterns of technologies are functions of their own market share and those of others, which reproduce standard observed S-shaped diffusion profiles (a so-called evolutionary replicator dynamics equation, or Lotka–Volterra competition equation51,52,53). FTT does not use optimization algorithms, and it is a time-step path-dependent simulation model (see Supplementary Table 1).

It is crucial to note that FTT projects the evolution of technology in the future by extending the current technological trajectory with a diffusion algorithm calibrated on recent history. The key property of FTT, strong path-dependence (or strong autocorrelation in time), typically found in technology transitions48,54,55, is given to the model by two features. (1) Technologies with larger market shares have a proportionally greater propensity to increase their market share, until they reach market domination. This is a key stylized feature of the diffusion of innovations48,55,56. (2) Continuity of the technological trajectory at the transition year from historical data to the projection (2013 ± 3–5 years) is obtained by empirically determining cost factors (denoted γ; see below and Supplementary Fig. 8). Since the diffusion of innovations typically evolves continuously, there should not be a change of trajectory at the transition from history to projection. By ensuring that this is so, we obtain a baseline trajectory in which some new low-carbon technologies (for example, hybrid and electric vehicles, solar photovoltaics) already diffuse to non-negligible or substantial market shares, and some traditional vehicle types decline (for example, small motorcycles in China). This baseline (the Technology Diffusion Trajectory scenario) includes current policies implicitly in the data; that is, they are not specified explicitly. The introduction of additional policy, in later years, results in further gradual changes to the technological trajectory, typically after 2025, differences that become further from the baseline along the simulation time span. Sensitivity analysis (Supplementary Table 3) shows that these trajectories are robust under substantial changes of all relevant technological parameters.

The γ factors are determined in the following way. Historical databases were carefully constructed by the authors by combining various data sources (transport and household heating; see Supplementary Table 1) or taken from IEA statistics (power generation). The γ values are added to the respective levelized cost that is compared among options by hypothetical (heterogeneous) agents in the model26,50. One and only one set of γ values ensures that the first 3–5 years of projected diffusion features the same trajectory (time-derivative of market shares) as the last 3–5 years of historical data from the start date of the various simulations (2012 for transport, 2013 for power, 2015 for heat; see Supplementary Fig. 8 for an example). This is the sole purpose of γ. The interpretation of γ is a sum of all pecuniary or non-pecuniary cost factors not explicitly defined in the model, which includes agent preferences and existing incentives from current policy frameworks, as well as implicit valuations of non-pecuniary factors such as (for vehicles) engine power, comfort and status. While the heterogeneity of agents is explicitly specified in FTT cost data and handled by the model (through empirical cost distributions; see for example ref. 50), γ are constant scalar values (not distributed or time-dependent). As is the case for any parameter determined with historical data, the further we model in the future, the less reliable the γ values are, but, just as with regression parameters, they do represent our best current knowledge as inferred from history.

The fossil fuel supply model

The supply of oil, coal and gas, in primary form, is modelled using a dynamical resource depletion algorithm28. It is equivalent in function and theory to that recently used by McGlade and Ekins6. Cost distributions of non-renewable resources are used, on the basis of an extensive survey of global fossil fuel reserves and resources28. The algorithm is then used to evaluate how resources are depleted, and how their marginal cost changes as the demand changes (that is, which is the most costly extraction venture, given extraction rates for all other extraction sites in production, supplying demand). As reserves are consumed and/or demand increases, fossil fuel resources previously considered to be uneconomic come online, requesting price increases. Meanwhile, when demand slumps, the most costly extraction ventures are first to shut down production (for example, deep offshore, oil sands). The data are disaggregated geographically following the E3ME regional classification.

The model assumes that the marginal cost sets the price, thus excluding effects on the price by events such as armed conflicts, processing bottlenecks (for example, refineries coming online and offline) and time delays associated with new projects coming online. While fossil fuel price changes may not always immediately follow changes in the marginal cost in reality, differences are cyclical (due to the ability of firms to cross-subsidize and produce at a loss for a limited time), and the long-term trend is robust. Taxes and duties on fuels, which differ in every region of the world, are not included in Fig. 2 or in the calculation of SFFA. E3ME includes end-user fuel prices from the IEA database, including taxes. The source for energy price data is the IEA. In the scenarios, we do not explicitly include the phase-out of fossil fuel subsidies, but the carbon price, when applied to fuels, effectively turns the subsidies into taxes. It is noted that some of the largest fuel subsidies are in countries that are energy exporters and that reducing or removing the subsidies would help to support public budgets (although doing so increases pressure on households). End-user prices are updated during the simulation to reflect changes in fossil fuel marginal costs from the fossil fuel supply model; however, end-user prices are not used in the calculation of SFFA. Behavioural assumptions over production decisions have important impacts in this submodel, described further below.

The GENIE model

GENIE is a global climate–carbon-cycle model, applied in the configuration of ref. 57, comprising the GOLDSTEIN (Global Ocean Linear Drag Salt and Temperature Equation INtegrator) three-dimensional ocean coupled to a two-dimensional energy–moisture-balance atmosphere, with models of sea ice, the ENTSML (Efficient Numerical Terrestrial Scheme with Managed Land) terrestrial carbon storage and land-use change, BIOGEM (BIOGEochemistry Model) ocean biogeochemistry, weathering and SEDGEM (SEDiment GEochemistry Model) sediment modules57–61. Resolution is 10° × 5° on average with 16 depth levels in the ocean. To provide probabilistic projections, we perform ensembles of simulations using an 86-member set that varies 28 model parameters and is constrained to give plausible post-industrial climate and CO2 concentrations62. Simulations are continued from ad 850 to 2005 historical transients63. Post-2005 CO2 emissions are from E3ME, scaled by 9.82/8.62, to match estimated total emissions64, accounting for sources not represented in E3ME, and extrapolated to zero at 2079. For the 2 °C scenario, non-CO2 trace gas radiative forcing and land-use-change maps are taken from Representative Concentration Pathway 2.6 (ref. 65). For the purposes of validation, the GENIE ensemble has been forced with the Representative Concentration Pathway scenarios, and these simulations are compared with the CMIP5 (Coupled Model Intercomparison Project Phase 5) and AR5 (IPCC Fifth Assessment Report) EMIC (Earth system Model of Intermediate Complexity) ensembles in Supplementary Table 6.

In the 2 °C scenario, median peak warming relative to 2005 is 1.00 °C, with 10% and 90% percentiles of 0.74 °C and 1.45 °C, respectively. Corresponding values for peak CO2 concentration are 457, 437 and 479 ppm, respectively. Total warming from 1850–1900 to 2003–2012 is estimated as 0.78 ± 0.06 °C (ref. 66), giving median peak warming relative to pre-industrial levels of 1.78 °C. Ensemble distributions of warming and CO2 are plotted in Supplementary Fig. 1. Oscillations are associated with reorganizations of ocean circulation or snow-albedo feedbacks rendered visible by the lack of chaotic variability in the simplified atmosphere.

It could be questioned why such a detailed climate model is needed in this analysis. One key aspect of our analysis is the quantification of additional SFFA that arise due to climate policy. For this quantification to be meaningful, it is also necessary to quantify the climate and carbon-cycle uncertainties that are associated with these policies (here, a 75% probability of avoiding 2 °C warming). Rapid decarbonization pathways lie outside the Representative Concentration Pathways framework, so that our physically based climate–carbon-cycle model is a more appropriate and robust tool than, for example, an emulator under extrapolation.

Data availability

The data that support the findings of this study are available from Cambridge Econometrics, but restrictions apply to the availability of these data, which were used under licence for the current study, and so are not publicly available. Data are, however, available from the authors upon reasonable request and with the permission of Cambridge Econometrics.

References

World Energy Investment (OECD/IEA, 2017).

World Energy Outlook (OECD/IEA, 2016).

Global Trends in Renewable Energy Investment (UNEP, 2016).

Global EV Outlook (OECD/IEA, 2017).

Paris Agreement Article 2(1)(a) (UNFCCC, 2015); http://unfccc.int/files/essential_background/convention/application/pdf/english_paris_agreement.pdf

McGlade, C. & Ekins, P. The geographical distribution of fossil fuels unused when limiting global warming to 2 °C. Nature 517, 187–190 (2015).

McGlade, C. & Ekins, P. Un-burnable oil: an examination of oil resource utilisation in a decarbonised energy system. Energy Policy 64, 102–112 (2014).

Sussams, L. & Leaton, J. Expect the Unexpected: The Disruptive Power of Low-Carbon Technology (Carbon Tracker and Grantham Institute, 2017); https://www.carbontracker.org/reports/expect-the-unexpected-the-disruptive-power-of-low-carbon-technology

Leaton, J. & Sussams, L. Unburnable Carbon: Are the World’s Financial Markets Carrying a Carbon Bubble? (Carbon Tracker, 2011); https://www.carbontracker.org/reports/carbon-bubble/

Heede, R. & Oreskes, N. Potential emissions of CO2 and methane from proved reserves of fossil fuels: an alternative analysis. Glob. Environ. Change 36, 12–20 (2016).

Carney, M. Breaking the Tragedy of the Horizon—Climate Change and Financial Stability—Speech by Mark Carney (Bank of England, 2015); http://www.bankofengland.co.uk/publications/Pages/speeches/2015/844.aspx

The Impact of Climate Change on the UK Insurance Sector (Bank of England Prudential Regulation Authority, 2015); https://www.bankofengland.co.uk/-/media/boe/files/prudential-regulation/publication/impact-of-climate-change-on-the-uk-insurance-sector.pdf

Recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD, 2017); https://www.fsb-tcfd.org/wp-content/uploads/2017/06/FINAL-TCFD-Report-062817.pdf

Battiston, S., Mandel, A., Monasterolo, I., Schütze, F. & Visentin, G. A climate stress-test of the financial system. Nat. Clim. Change 7, 283–288 (2017).

Nachmany, M. et al. The Global Climate Legislation Study—2016 Update (LSE and Grantham Institute, 2016); http://www.lse.ac.uk/GranthamInstitute/publication/2015-global-climate-legislation-study/

Marrakech Action Proclamation for Our Climate and Sustainable Development (UNFCCC, 2016); https://unfccc.int/files/meetings/marrakech_nov_2016/application/pdf/marrakech_action_proclamation.pdf

Sinn, H.-W. Public policies against global warming: a supply side approach. Int. Tax Public Finance 15, 360–394 (2008).

Blanchard, O. J. The Crisis: Basic Mechanisms, and Appropriate Policies Working Paper WP/09/80 (IMF, 2008); https://www.imf.org/external/pubs/ft/wp/2009/wp0980.pdf

Clarke, L. et al. in Climate Change 2014: Mitigation of Climate Change (eds Edenhofer, O. et al.) Ch. 6 (IPCC, Cambridge Univ. Press, 2014).

McCollum, D. L. et al. Quantifying uncertainties influencing the long-term impacts of oil prices on energy markets and carbon emissions. Nat. Energy 1, 16077 (2016).

Bauer, N. et al. CO2 emission mitigation and fossil fuel markets: dynamic and international aspects of climate policies. Technol. Forecast. Social Change 90, 243–256 (2015).

Mercure, J.-F. et al. Environmental impact assessment for climate change policy with the simulation-based integrated assessment model E3ME-FTT-GENIE. Energy Strategy Reviews 20, 195–208(2018).

Mercure, J.-F., Pollitt, H., Bassi, A. M., Viñuales, J. E. & Edwards, N. R. Modelling complex systems of heterogeneous agents to better design sustainability transitions policy. Glob. Environ. Change 37, 102–115 (2016).

Mercure, J. et al. Policy-induced Energy Technological Innovation and Finance for Low-carbon Economic Growth. Study on the Macroeconomics of Energy and Climate Policies (European Commission, 2016); https://ec.europa.eu/energy/sites/ener/files/documents/ENER%20Macro-Energy_Innovation_D2%20Final%20(Ares%20registered).pdf

Mercure, J.-F. et al. The dynamics of technology diffusion and the impacts of climate policy instruments in the decarbonisation of the global electricity sector. Energy Policy 73, 686–700 (2014).

Mercure, J.-F., Lam, A., Billington, S. & Pollitt, H. Integrated assessment modelling as a positive science: private passenger road transport policies to meet a climate target well below 2 degrees C. Preprint at https://arxiv.org/abs/1702.04133 (2018).

Fuss, S. et al. Betting on negative emissions. Nat. Clim. Change 4, 850–853 (2014).

Mercure, J.-F. & Salas, P. On the global economic potentials and marginal costs of non-renewable resources and the price of energy commodities. Energy Policy 63, 469–483 (2013).

World Energy Outlook (OECD/IEA, 2014).

The E3ME Model (Cambridge Econometrics, 2017); http://www.e3me.com

Barker, T., Alexandri, E., Mercure, J.-F., Ogawa, Y. & Pollitt, H. GDP and employment effects of policies to close the 2020 emissions gap. Clim. Policy 16, 393–414 (2016).

Pollitt, H., Alexandri, E., Chewpreecha, U. & Klaassen, G. Macroeconomic analysis of the employment impacts of future EU climate policies. Clim. Policy 15, 604–625 (2015).

Pollitt, H. & Mercure, J.-F. The role of money and the financial sector in energy-economy models used for assessing climate and energy policy. Clim. Policy 18, 184–197 (2017).

Lavoie, M. Post-Keynesian Economics: New Foundations (Edward Elgar, Cheltenham, 2014).

McLeay, M., Radia, A. & Thomas, R. Money in the Modern Economy: An Introduction (Bank of England, 2014); http://www.bankofengland.co.uk/publications/Pages/quarterlybulletin/2014/qb14q1.aspx

McLeay, M., Radia, A. & Thomas, R. Money Creation in the Modern Economy (Bank of England, 2014); http://www.bankofengland.co.uk/publications/Pages/quarterlybulletin/2014/qb14q1.aspx

Employment Effects of Selected Scenarios from the Energy Roadmap 2050 (Cambridge Econometrics, 2013); http://ec.europa.eu/energy/sites/ener/files/documents/2013_report_employment_effects_roadmap_2050_2.pdf

Assessing the Employment and Social Impact of Energy Efficiency (Cambridge Econometrics, 2015); https://ec.europa.eu/energy/sites/ener/files/documents/CE_EE_Jobs_main%2018Nov2015.pdf

Lee, S., Pollitt, H. & Park, S.-J. (eds) Low-Carbon, Sustainable Future in East Asia: Improving Energy Systems, Taxation and Policy Cooperation (Routledge, London, 2015).

Ackerman, F., DeCanio, S. J., Howarth, R. B. & Sheeran, K. Limitations of integrated assessment models of climate change. Clim. Change 95, 297–315 (2009).

Pindyck, R. S. Climate change policy: what do the models tell us? J. Econ. Lit. 51, 860–872 (2013).

Weyant, J. P. A perspective on integrated assessment. Clim. Change 95, 317–323 (2009).

Geels, F. W., Berkhout, F. & van Vuuren, D. P. Bridging analytical approaches for low-carbon transitions. Nat. Clim. Change 6, 576–583 (2016).

Turnheim, B. et al. Evaluating sustainability transitions pathways: bridging analytical approaches to address governance challenges. Glob. Environ. Change 35, 239–253 (2015).

Popp, D. & Newell, R. Where does energy R&D come from? Examining crowding out from energy R&D. Energy Econ. 34, 980–991 (2012).

Hottenrott, H. & Rexhäuser, S. Policy-induced environmental technology and inventive efforts: is there a crowding out? Ind. Innov. 22, 375–401 (2015).

Barker, T. & Crawford-Brown, D. (eds) Decarbonising the World’s Economy: Assessing the Feasibility of Policies to Reduce Greenhouse Gas Emissions (Imperial College Press, London, 2014).

Grübler, A., Nakićenović, N. & Victor, D. G. Dynamics of energy technologies and global change. Energy Policy 27, 247–280 (1999).

Mercure, J.-F. FTT:Power: a global model of the power sector with induced technological change and natural resource depletion. Energy Policy 48, 799–811 (2012).

Mercure, J.-F. & Lam, A. The effectiveness of policy on consumer choices for private road passenger transport emissions reductions in six major economies. Environ. Res. Lett. 10, 064008 (2015).

Hofbauer, J. & Sigmund, K. Evolutionary Games and Population Dynamics (Cambridge Univ. Press, Cambridge, 1998).

Mercure, J.-F. Fashion, fads and the popularity of choices: micro-foundations for diffusion consumer theory. Preprint at https://arxiv.org/abs/1607.04155 (2018).

Mercure, J.-F. An age structured demographic theory of technological change. J. Evolut. Econ. 25, 787–820 (2015).

Geels, F. W. Technological transitions as evolutionary reconfiguration processes: a multi-level perspective and a case-study. Res. Policy 31, 1257–1274 (2002).

Wilson, C. Up-scaling, formative phases, and learning in the historical diffusion of energy technologies. Energy Policy 50, 81–94 (2012).

Rogers, E. M. Diffusion of Innovations (Simon and Schuster, New York, NY, 2010).

Holden, P. B., Edwards, N. R., Gerten, D. & Schaphoff, S. A model-based constraint on CO2 fertilisation. Biogeosciences 10, 339–355 (2013).

Marsh, R., Müller, S., Yool, A. & Edwards, N. Incorporation of the C-GOLDSTEIN efficient climate model into the GENIE framework: “eb_go_gs” configurations of GENIE. Geosci. Model Dev. 4, 957–992 (2011).

Ridgwell, A. & Hargreaves, J. Regulation of atmospheric CO2 by deep-sea sediments in an Earth system model. Glob. Biogeochem. Cycles 21, GB2008 (2007).

Ridgwell, A. et al. Marine geochemical data assimilation in an efficient Earth System Model of global biogeochemical cycling. Biogeosciences 4, 87–104 (2007).

Williamson, M., Lenton, T., Shepherd, J. & Edwards, N. An efficient numerical terrestrial scheme (ENTS) for Earth system modelling. Ecol. Model. 198, 362–374 (2006).

Foley, A. Climate model emulation in an integrated assessment framework: a case study for mitigation policies in the electricity sector. Earth Syst. Dynam. 7, 119–132 (2016).

Eby, M. et al. Historical and idealized climate model experiments: an intercomparison of Earth system models of intermediate complexity. Clim. Past 9, 1111–1140 (2013).

Jackson, R. B. et al. Reaching peak emissions. Nat. Clim. Change 6, 7–10 (2016).

Vuuren, D. P. et al. RCP2.6: exploring the possibility to keep global mean temperature increase below 2 °C. Clim. Change 109, 95–116 (2011).

IPCC: Summary for Policymakers. In Climate Change 2013: The Physical Science Basis (eds Stocker, T. F. et al.) (Cambridge Univ. Press, 2013).

Acknowledgements

The authors acknowledge C-EERNG and Cambridge Econometrics for support, and funding from EPSRC (J.-F.M., fellowship no. EP/K007254/1), the Newton Fund (J.-F.M., P.S., J.E.V., H.P., U.C., EPSRC grant no. EP/N002504/1 and ESRC grant no. ES/N013174/1), NERC (N.R.E., P.B.H., H.P., U.C., grant no. NE/P015093/1), CONICYT (P.S.), the Philomathia Foundation (J.E.V.), the Cambridge Humanities Research Grants Scheme (J.E.V.), Horizon 2020 (J.-F.M., F.K., Sim4Nexus project no. 689150) and the European Commission (J.-F.M., H.P., F.K., U.C., DG ENERGY contract no. ENER/A4/2015-436/SER/S12.716128). J.-F.M. acknowledges the support of L. J. Turner during extended critical medical treatment, and H. de Coninck and M. Grubb for discussions. We are grateful to N. Bauer for sharing data from his study.

Author information

Authors and Affiliations

Contributions

J.-F.M. designed and coordinated the research. J.-F.M., J.E.V., N.R.E., H.P. and I.S. wrote the article. J.-F.M., H.P. and U.C. ran simulations. U.C. and H.P. managed E3ME. J.-F.M. and A.L. developed FTT:Transport. J.-F.M. and P.S. developed FTT:Power and the resource depletion model. F.K. and J.-F.M. developed FTT:Heat. P.B.H. and N.R.E. ran GENIE simulations and provided scientific support on climate change. J.E.V. contributed geopolitical expertise.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s note: Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Supplementary Information

Supplementary notes 1–5, Supplementary tables 1–8, Supplementary figures 1–11, Supplementary references

Supplementary Data 1

Dataset for detailed public policies assumed in model scenarios

Rights and permissions

About this article

Cite this article

Mercure, JF., Pollitt, H., Viñuales, J.E. et al. Macroeconomic impact of stranded fossil fuel assets. Nature Clim Change 8, 588–593 (2018). https://doi.org/10.1038/s41558-018-0182-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1038/s41558-018-0182-1